I have been thinking about the collapse of NVIDIA in light of earnings on 2/26 and the public release of DeepSeek on 1/27. I think it’s a classic head-fake1.

. . .

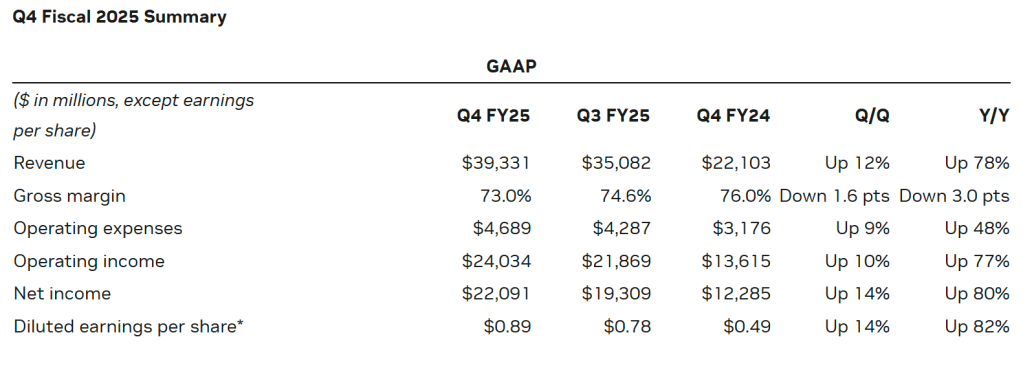

Let’s first review the Q4 FY25 numbers.

NVDA FY25 Q4 earnings released on 2/26/25

Revenue beat of $39.3B vs. consensus of $38.3B, a 78% increase yoy.

Net income beat of $22.1B vs. consensus of $21.1B, a 80% increase yoy.

EPS at 89 cents, a 82% increase yoy.

Gross margin at 73%.

Analyst sentiment remains overwhelmingly positive, with 17 out of 18 analysts issuing “buy” and one hold as of 2/20.

The consensus price target is approximately $175, +50% from current levels.

These are astounding results for any company, let alone one at the forefront of the next industrial revolution that is generative AI.

I don’t really want to get into valuation metrics as I am a growth investor and make my decisions based on growth, not value.

Sorry to be so pedantic, but I don’t understand why very educated folks (especially on TV) keep bringing up P/E with a name like NVDA.

Here is the earnings call transcript.

. . .

Since many of my subscribers actually manage money professionally for very large institutions like pensions and sovereign wealth funds, I am now obliged to provide you with an “equity research” styled report on what is happening with NVDA and perhaps the broader U.S. equity markets (I may be wrong).

Yes, I do have some experience digesting equity research reports as I spent most of my career in finance on the buy-side as an assistant PM at J.P. Morgan, a PM at Partners Group and an assistant oil trader at Mitsui Bussan Commodities.

So without further ado, I believe these are the 6 (perhaps more) fundamental forces driving the short-term price collapse in NVDA.

. . .

1. Geopolitical Stability and Alliances

Mohamed El-Erian -> Allianz Global Investors

2. Economic Factors and Inflation

Ray Dalio -> Bridgewater Associates

3. Financial Markets and Investor Sentiment

Howard Marks -> Oaktree Capital

4. Economic Policy and Central Bank Actions

5. China’s Trade Policies and U.S. Manufacturing

Phillip Wool -> Rayliant Global Advisors

6. U.S. Industrial Base and Defense Spending

US Congress -> Library of Congress

. . .

Sorry, I only told you I was good at digesting equity research reports, not that I was actually good at producing them.2

If you need help connecting the dots from all these sources, just ask DeepSeek 🙂

It does a decent job.

. . .

Final words from Jensen Huang – which I believe to be accurate.

Demand for Blackwell is amazing as reasoning AI adds another scaling law — increasing compute for training makes models smarter and increasing compute for long thinking makes the answer smarter.

. . .

P.S.

1 In case you’re not aware of a head-fake trade:

A head-fake trade occurs when a security’s price moves in one direction, but then reverses course and moves in the opposite direction.

2 I actually enjoy writing quite a bit, but my style is more informal and much less rigid than the “academic essays” found in equity style research reports.

I will try to distill many different primary and secondary sources (I consider myself a tertiary investment provider) and highlight sources which I believe to be most credible (hence the 6 sources I provided for the 6 forces I noted).

Leave a comment