It was Monday, February 5th, 2018 and I was visiting Vail, Colorado on the backend of a work trip to Denver as Head of Institutional Sales at ProShares.

The snow was beginning to fall when I received an emergency phone call from my boss back in New York.

He told me to stop all client communications on our volatility-based ETFs that tracked the VIX – namely a 2x long version (UVXY) and a -2x short version (SVXY).

By the day’s end, billions were loss by investors who own Credit Suisse’s exchange-traded notes (ETNs) that were levered short the VIX (XIV). Untold billions lost by investors across equities, fixed income, and commodities due to a volatility snap. It was a full-blown meltdown of the VIX market, one of the most active market globally.

I myself was lucky as I was short SVXY for all of 2017 and up to the events leading to “Volmageddon” – that faithful Monday in February 2018 when SVXY died (at least the -2x version, it’s -1.5x now). Myself and quite a few “Black Swan” speculators made a decent amount on that day however.

. . .

What happened?

A popular carry trade among professional investors was to go “short vol” or long an inverse VIX like ProShares’ SVXY ETF or Credit Suisse’s XIV ETN.

This has been a fairly good source of carry for many hedge fund managers due to the period of protracted quantitative easing and low interest rate environment.

Everyone thought the music would keep on playing as the financial markets were in “quantitative easing bliss” – a delusional economic slumber induced by the Fed that fueled the market rally coming out of the 2008 subprime mortgage crisis.

On that day, the “Volmageddon” that caused -2x levered VIX products to collapse had been waiting happen for years – everyone was dancing and collecting short volatility tickets until the music stopped playing on 2/5/2018.

Out of the ashes of Volmageddon, 5 Credit Suisse levered ETNs were shut down and ProShares toned down the leverage on UVXY (2x) and SVXY (-2x) to 1.5x.

So short volatility has a large tail risk and a decent carry trade, but what about long volatility? Does it have any use in as an independent strategy or within a portfolio?

. . .

Well, if you ask Eric Peters of One River Asset Management, he will tell you that long volatility is definitely where it’s at and it’s been that way for a long time, but no one was smart enough to realize that volatility is an amazing risk diversifier and return enhancer.

Eric has an impressive background and if you think about an Italian crime family syndicate of U.S. finance, Eric is the Consigliere to the Don that is Jamie Dimon.

Eric makes bold claims, executes on, and achieves amazing results for his investors.

If my investment fund Aidos LLC only does 10% of what Eric’s One River achieves, I will be very happy and would be set for a very comfortable retirement.

What does Eric do exactly?

According to his Form ADV, Peter is a hedge fund manager for a $4 billion hedge fund called One River Asset Management. He is also the CIO of Coinbase Asset Management.

One River Asset Management sells 3 main products:

A. Risk Mitigation Solutions

Risk Responders Strategy is the firm’s flavor du jour which shifts risk dynamically between long volatility and trend exposures over time.

Profit-taking is embedded into the model, relieving investors of the pressure to time their exit from the strategy and this allows it to be held through the cycle as a source of positive portfolio convexity.

This is Eric’s bread and butter and likely what made him rich and famous.

B. Trend Strategies

Systematic Trend trades medium to long-term trends frequently observed in 62 of the world’s most liquid equity index, fixed income, foreign exchange, and commodity markets.

Systematic Alternative Markets Trend applies One River’s systematic trend algorithm to 110 more esoteric global markets including developing and emerging market interest rate swaps, emerging market foreign exchange, and European power and emissions markets.

C. Volatility Strategies

Volatility Relative Value is a market-neutral strategy that takes long/short positions in volatility markets across global equity index, foreign exchange, interest rate, and commodity volatility markets.

Dynamic Convexity trades volatility futures, volatility options, and option on major global equity indexes from the long-side only.

Dispersion Alpha seeks to generate alpha from dislocations between the index volatility and its constituents’ volatility.

I think these “volatility strategies” are just Lego combinations based on Eric’s main strategy which is his ability to construct a robust long volatility strategy and pairs it as a diversifier to a macro trend following strategy. This is Eric’s “Risk Responders Strategy.”

Okay, enough about how great Eric is.

What is his secret sauce?

. . .

Well, he takes a “total portfolio approach” to trading long volatility.

Why long volatility?

Well, markets are driven by human emotions.

The only thing you can count on human emotion is that it we will get angry and scared when we trade money.

Angry and scared due to ego.

Angry and scared when the S&P 500 is down 10% for the day and there’s no end in sight.

Long volatility capitalizes on this fundamental human condition.

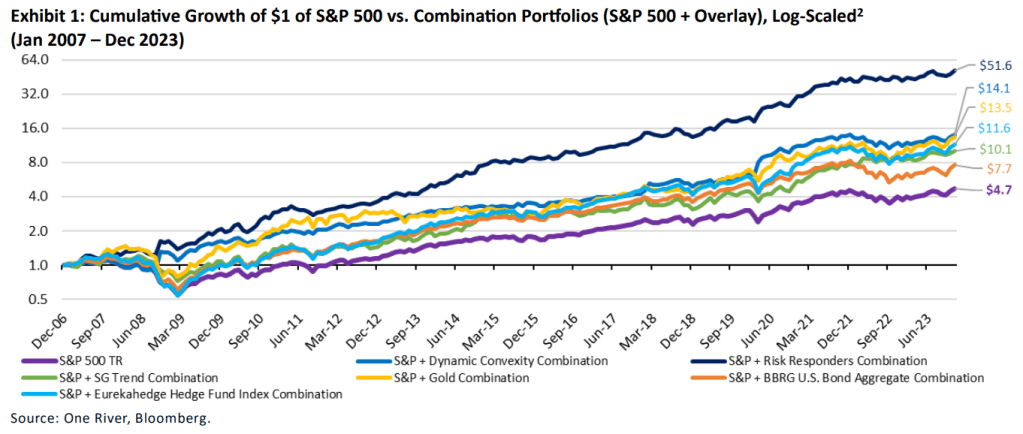

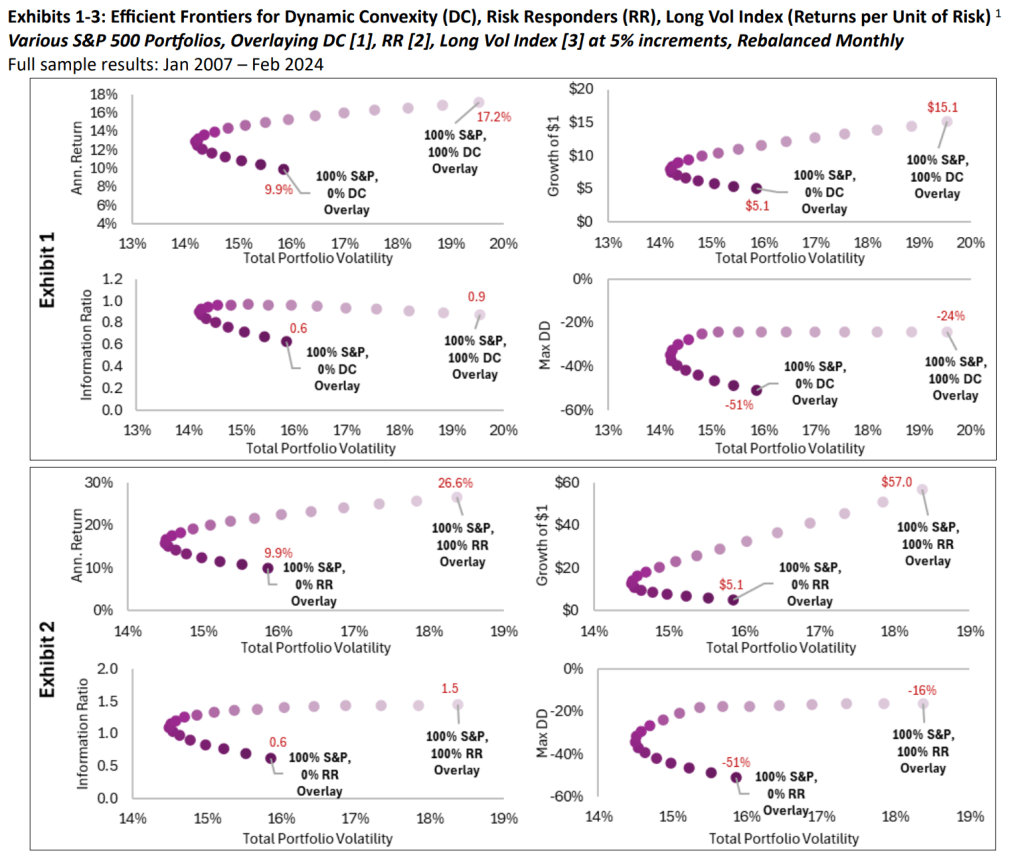

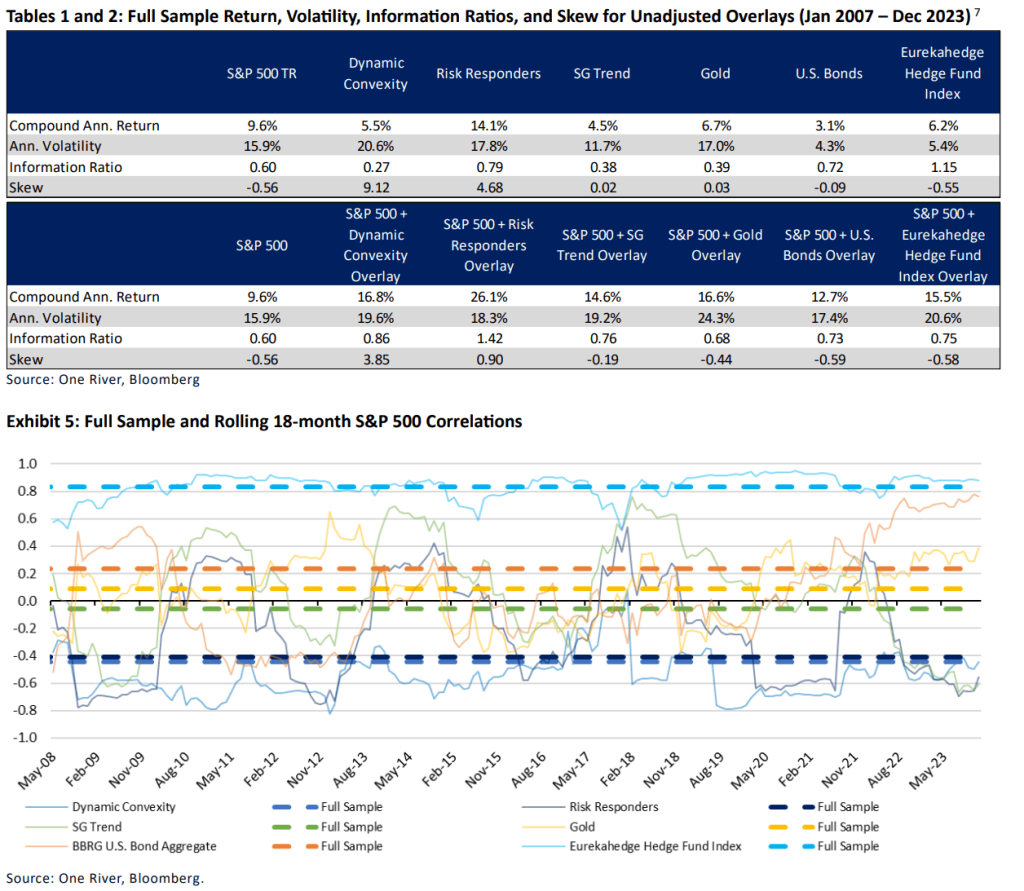

As shown above, an equity portfolio (S&P 500) can be improved substantially by overlaying an allocation to long volatility. Furthermore, dynamic adjustments between varying mixtures of equity convexity (labeled DC overlay) and vol-trend switch (labeled RR overlay) yields an improved efficient frontier allocation.

One can easily adjust their risk tolerance on the new and improved efficient frontiers to their desired risk appetite. That being said, a 100% equity convexity or 100% vol-tend switch yielded the most optimal risk-return results from the backtests and real-life results that are shared by One River Asset Management.

. . .

Seeing as now we’re in an aspiring fascist society that is the United States, the world will be going through a period of great uncertainty driven by immense geopolitical developments, the rapid rise of generative AI, and a new world order rearrangement.

Could Donald and Elon become the the world’s new Don and Consigliere?

I am a believer in the total portfolio approach to investing and my firm Aidos LLC is in fact a long volatility-biased investor, who is focused on event-driven trading in growth tech, namely in generative AI names like NVDA, TSM & AVGO.

Eric’s approach to long vol is not unique, but his success indicates he has clearly honed his craft for structuring long vol trades and specifically overlay strategies.

What is Eric’s total portfolio approach?

Well for a pension fund manager, instead of abiding by strict strategic asset allocations to say 60% equities (developed vs. emerging) and 40% fixed income (investment grade vs. high yield), the manager instead focuses on outcomes for their beneficiaries.

One outcome would simply that the fund beats inflation (CPI + 2%) or that achieves an annual hurdle (say 8% average annual total return).

Another outcome would be to maximize the funded ratio while minimizing funding risk.

These are objective-based outcomes that would best align with the beneficiaries of the pension – namely retiring employees of large corporations or government agencies.

According to Eric:

Allocators who adhere to these total portfolio principles tend to focus less on asset class exposures and more on broad factor / market beta exposures. This competition for capital usage leads to a premium on capital efficiency. Therefore, these investors tend to make more efficient use of capital through derivatives, and they also tend to make use of more economic leverage when it is beneficial.

By focusing on applying this total portfolio principle and a strong conviction for the value of long volatility as a strong risk-adjusted return enhancer, Eric has achieved these remarkable results shown below.

. . .

Great, so long volatility.

Sounds simple, but to understand volatility requires a deep understanding of options and human psychology.

My event-driven investment fund Aidos is actually long volatility as I generally expect a sharp pickup in volatility post the earnings call for the names I trade in like NVDA & TSM.

Here is a summary of Aidos:

Aidos an event-driven investment fund in growth tech. We seek to generate a positive asymmetric risk profile for our clients by identifying high conviction themes like generative AI. By leveraging data science techniques and a deep understanding of machine learning and human psychology, we are then able to identify and execute on trade ideas that capitalize on these high conviction themes.

Partly because of our long volatility bias, we are also long “Black Swan” events.

The Black Swan is a term coined by Nassim Taleb, who is an options trader. In his book, Nassim dives into extreme impact of rare and unpredictable outlier events—and the human tendency to find simplistic explanations for these events, retrospectively.

Maybe, just like Natalie Portman’s character in Tchaikovsky’s Swan Lake, we can all start dancing again once the music starts back up again.

The music I believe is the next market economic cycle fueled by Generative AI, Agentic AI (specialized, independent AI systems) and Physical AI (AI systems like autonomous cars and androids that interact with the real world)

I expect the music to start again sooner rather than later 🙂

. . .

Leave a comment