Preface: this is very high risk/reward trade if your time horizon is less than a year. I expect this trade to reach greater probabilities of success as Trump’s second term ends. This is not a direct trade from my “high conviction themes.” It is an indirect AI trade benefitting from Trump’s “U.S. exceptionalism” policies and its impact on our relationship with China and Taiwan (TSMC) – as tariffs appears to be Trump’s main weapon of international warfare.

. . .

Let’s first dive into the history of Trump Media & Technology Group (TMTG).

TMTG is no doubt a reference to TMT (technology, media, and telecom) investment banking’s prestigious place among finance professionals, an area that Trump unfortunately has had no significant success in, despite his claims in his book “The Art of the Deal.”

TMTG was founded by no other than two of Trump’s protogees from “The Apprentice” – Andy Dean and and Wes Moss.

Andy didn’t have much of a career before “The Apprentice” – his only notable achievement being that he went to “Harvard and graduated in 2005 with a degree in government.”

Wes’s background is even more ambiguous and all I can dig up his that he is a financial planner in Atlanta who didn’t have much of a career before “The Apprentice.”

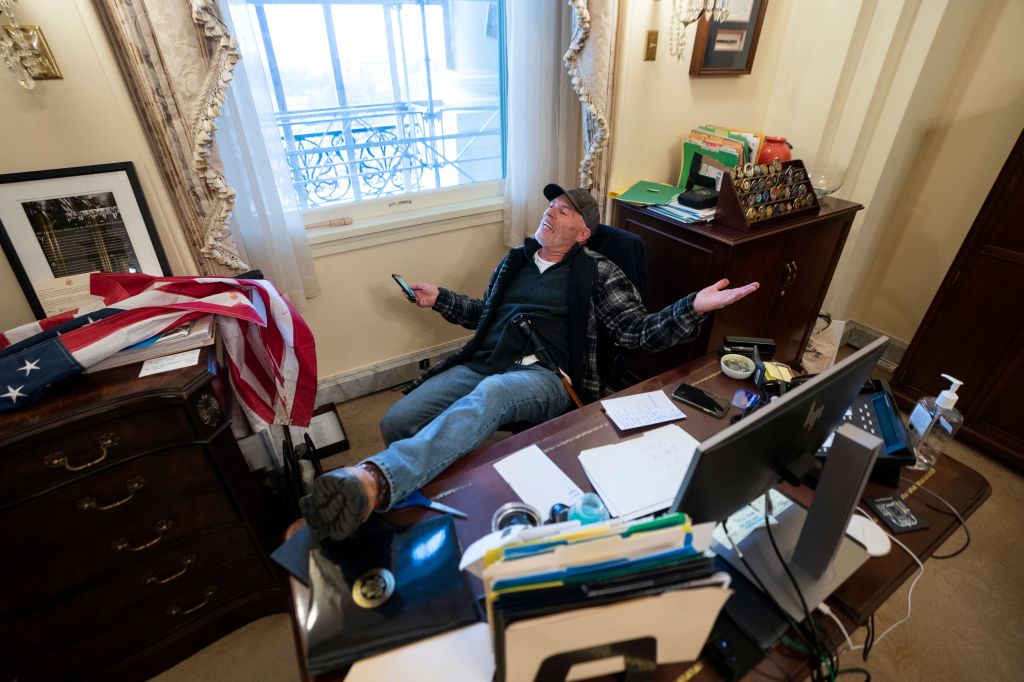

TMTG was formed in February 2021, a month after Trump was banned on Twitter for his role in the January 6 United States Capital attack.

It would not surprise me to learn that TMTG and DJT exist because of Trump’s ego from being bruised by his Twitter ban.

Trump has done far worse, and it’s all been led by his ego.

Don’t be surprise if this is the truth behind DJT.

. . .

You can read much more about TMTG here, but it’s basically Trump’s business to capitalize on his political power.

TMTG went public as DJT in March 26, 1014 after merging with Digital World Acquisition Corp. (a SPAC) – 7 months before Trump wins the 2024 election.

Yes, I mentioned DJT came out of a SPAC. Yes, big surprise.

I’m not going to recite to you all the bad (and some good) things that Trump has done since taking office, but there are some pretty egregious ones.

Most of them are offensive, but don’t have much economic or trade impact.

However Trump’s continued false narrative of “U.S. exceptionalism” doesn’t hold much weight by anyone with an IQ > 120 and may be his undoing.

Trump’s bluff is pretty obvious to even the most amateur of poker players, let alone our smart allies (Canada and Mexico called him out), and even more so from our smarter enemies (Vladimir and Xi are probably having slumber parties now).

The only person who doesn’t realize this is Trump himself.

Unfortunately, his ego will be his undoing.

. . .

My investment thesis here is simple.

Trump is leading America to a fascist regime governed by the ultra rich, tech entrepreneurs. His aggressive approach is short-sighted and will have permanent impact on the U.S. role in a new world order – a new world order where power is gradually shifting to the East, squarely in the hands of China and Russia.

I believe Trump’s ego and his parrot Cabinet will be his downfall and I expect DJT’s long-term performance to reflect investors realization of Trump’s narcissistic nature which has been cleverly masked in a thin veneer of “U.S. exceptionalism.”

That said, I may be wrong, maybe in the short-term as:

Markets can remain irrational longer than you can remain solvent.

-John Maynard Keynes

P.S. There’s a great movie out now called Mickey 17 – it does an excellent job of portraying the relationship between Donald Trump and Elon Musk and the implications for humanity if their plans are successful.

Leave a comment