J.D. Vance recently spoke at the third American Dynamism Summit in Washington, DC on the morning of March 18, 2025.

Here is the relevant part of his speech for investors.

. . .

“There were two conceits that our leadership class had when it came to globalization.”

“The first is assuming that we can separate the making of things from the design of things. The idea of globalization was that rich countries would move further up the value chain, while the poor countries made the simpler things.”

“But I think we got it wrong. It turns out that the geographies that do the manufacturing get awfully good at the designing of things. There are network effects, as you all well understand. The firms that design products work with firms that manufacture. They share intellectual property. They share best practices. And they even sometimes share critical employees.”

“Now, we assumed that other nations would always trail us in the value chain, but it turns out that as they got better at the low end of the value chain, they also started catching up on the higher end. We were squeezed from both ends. Now, that was the first conceit of globalization.”

“I think the second is that cheap labor is fundamentally a crutch, and it’s a crutch that inhibits innovation. I might even say that it’s a drug that too many American firms got addicted to. Now, if you can make a product more cheaply, it’s far too easy to do that rather than to innovate.”

“And whether we were offshoring factories to cheap labor economies or importing cheap labor through our immigration system, cheap labor became the drug of Western economies.”

“And I’d say that if you look in nearly every country, from Canada to the UK, that imported large amounts of cheap labor, you’ve seen productivity stagnate. I don’t think that’s not a total happenstance. I think that the connection is very direct.”

“But the fundamental premise, the fundamental goal of President Trump’s economic policy is, I think, to undo 40 years of failed economic policy in this country. For far too long, we got addicted to cheap labor — both overseas and by importing it into our own country — and we got lazy.”

“We overregulated our industries instead of supporting them. We overtaxed our innovators, instead of making easier for them to build their great companies, and we made it way too hard to build things and invest things in the United States of America.”

. . .

Let’s take a step back and review J.D. Vance’s background and experience.

Born of Scots-Irish descent, James Donald Bowman as born on August 2, 1985 and spent his youth living with his family in Jackson, Kentucky.

After a tumultuous family upbringing – one where his mother remarried twice – James Bowman changed his name to J.D. Vance.

After graduating from high school, J.D. enlisted in the U.S Marine Corps, serving as a military journalist with the 2nd Marine Aircraft Wing. During his four years of service, he was only deployed to the Iraq War for six months in a non-combat role.

After leaving the military, he used benefits from the G.I. Bill to study political science and philosophy at Ohio State University and went on to attend Yale Law School, where he was on the staff of the Yale Law Journal.

After law school and brief stints working for Republican senator John Cornyn and Jude David Bunning of the U.S. District Court for the Eastern District of Kentucky, J.D. worked as a corporate lawyer for Sidley Austin.

His corporate law career was short-lived, before he served as a principal at Peter Thiel’s investment firm – Mithril Capital.

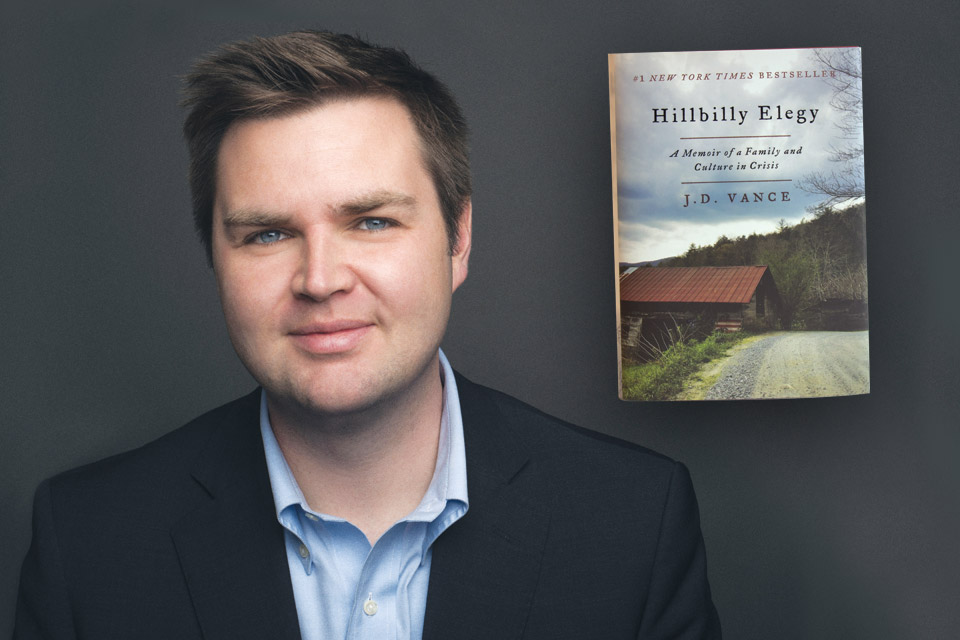

J.D. Vance claimed notoriety when he published his book “Hillbilly Elegy: A Memori of a Family and Culture in Crisis.” The memoir recounts the Appalachian culture and socioeconomic problems of Vance’s small-town upbringing.

Not much is known about his “Appalachian” upbringing outside of what J.D. has said.

That’s really J.D.’s entire career – a stint in the U.S Marine Corps as a journalist, corporate lawyer, investor, and writer for a book on “Appalachian” culture.

In many ways, his profile fit exactly what Trump wanted in his V.P. candidate – a brilliant orator who is able to craft whatever story fits Trump’s narratives.

J.D. Vance did a notable job crafting the “U.S. exceptionalism” narrative for Trump by reframing it as a “American Dynamism.” It’s actually not bad, and brilliant.

The New Yorker has an interesting take on this type of psychological behavior.

A liberal has to tell a hundred stories, or a thousand. A communist has one story, which might not turn out to be true. A fascist just has to be a storyteller. Because words do not attach to meanings, the stories don’t need to be consistent. They don’t need to accord with external reality. A fascist storyteller just has to find a pulse and hold it. This can proceed through rehearsal, as with Hitler, or by way of trial and error, as with Trump.

Timothy Snyder

. . .

So where do we go from here?

Do you believe in Trump’s narrative to reignite “American Dynamism” after we have succumbed to the drugs of globalization and cheap labor for the past 40 years?

Or do you believe something is off with this narrative and perhaps this narrative is stinkingly similar to the narrative of other fascist leaders like Mussolini, Hitler, and Putin?

I’ll leave it to you to decide but will just share what this “American Dynamism” and “U.S. Exceptionalism” narrative means from an investment perspective.

Asset Allocation Implications

Expect a continued narrative of an equity overweight to bonds.

Within equities, asset owners will be shifting to public equity funded by private equity.

Within public equities, investors will continue to shift to European equities over U.S.

Expect China equities to outperform U.S. and even European equities this year.

Active Investing Implications

In stagflation, with high geopolitical and equity market volatility, it’s hard to earn an outsized return as a passive investor.

I expect active investors to do really well during Trump’s second term.

Emphasis on active and also you must be good. If you have a truly differentiated edge as a hedge fund, special situations, or opportunistic investor, I expect you to do very well.

There’s plenty of opportunity for both the long and short side – especially in the area of AI stocks – and I expect L/S equity investors to be handsomely rewarded.

More so than ever, the game now appears to be trades that are highly convex on the upside and concave on the downside (concavity here indicates a contrarian view).

What an exciting time to be an active investor.

. . .

Leave a comment