Disclaimer: I have never been a professional merger arbitrage investor or trader. My professional experience with merger arb is when I was an investor at J.P. Morgan, and was conducting due diligence for our hedge fund of fund strategy (HFoF). As such, the exact mechanics and investment process of institutional managers can be significantly different than what I will be describing here.

I have always been interested in “event-driven investing” and of all the many strategies under this umbrella (earnings, index rebalancing, convertible arbitrage, activism), I think “merger arbitrage” is really the only strategy feasible for a retail investor (<$50M personal capital).

Historically, merger arbitrage of “merger arb” (henceforth) has been the domain of specialized institutional investors, including hedge funds like Elliott Management, and proprietary trading desks at major investment banks. While private equity firms act as the buyers in these transactions, and investment banks advise on them, arbitrageurs are the ones who police the spreads and provide necessary liquidity between the announcement and the closing of a deal.

Activism like the strategy executed by Bill Ackman of Pershing Square are distinct from merger arb, but often go hand-in-hand and complement each other. An activist may convince the board and CEO of a larger company to buyout a strategic asset, and the then have his merger arb team place a position in the deal before it closes. Properly disclosed, this is completely kosher with the SEC, and that’s why you sometimes see activists engage in a merger arb trade on the same deal.

To date, retail capital has largely ignored this strategy. It requires intense legal scrutiny, regulatory triage, and disciplined capital structuring rather than technical “chart reading” or fundamental earnings speculation.

It is possible to execute this strategy in a standard brokerage account, but you must fundamentally shift your mindset. You are no longer speculating on the directional value of a business based on its future earnings potential. You are acting as an underwriter of transaction completion risk. You are betting on a specific corporate outcome – a signed contract closing according to its terms – occurring within a specific timeframe.

In professional terms, merger arb is a market-neutral, event-driven strategy designed to generate an uncorrelated return stream – the risk is purely idiosyncratic. The objective is to profit from the spread between a target company’s current trading price following and M&A announcement and the consideration offered in the definitive purchase agreement (DPA).

The Institutional Objectives

Say a large fast casual restaurant (the acquirer) wants to acquire a smaller fast casual restaurant (the target company) that will expand its TAM young Gen-Z customers, and offers an all-cash deal to purchase the the target company at $100 / share. Even after the announcement is made public, the target company stock may still trade at $95 / share – the $5 difference is the spread. It exists because the market discount for:

- Time value of money: the deal may take 3 to 12 months to close.

- Deal risk: the possibility the transaction fails due to antitrust intervention, financing failures, shareholder rejection, or a material adverse effect (MAE) at the target.

The merger arb trader buys the target company stock at $95 in hopes of receiving $100 at closing. If the deal fails, the stock will usually revert to its pre-announcement price (perhaps $80 or lower), resulting in a significant loss.

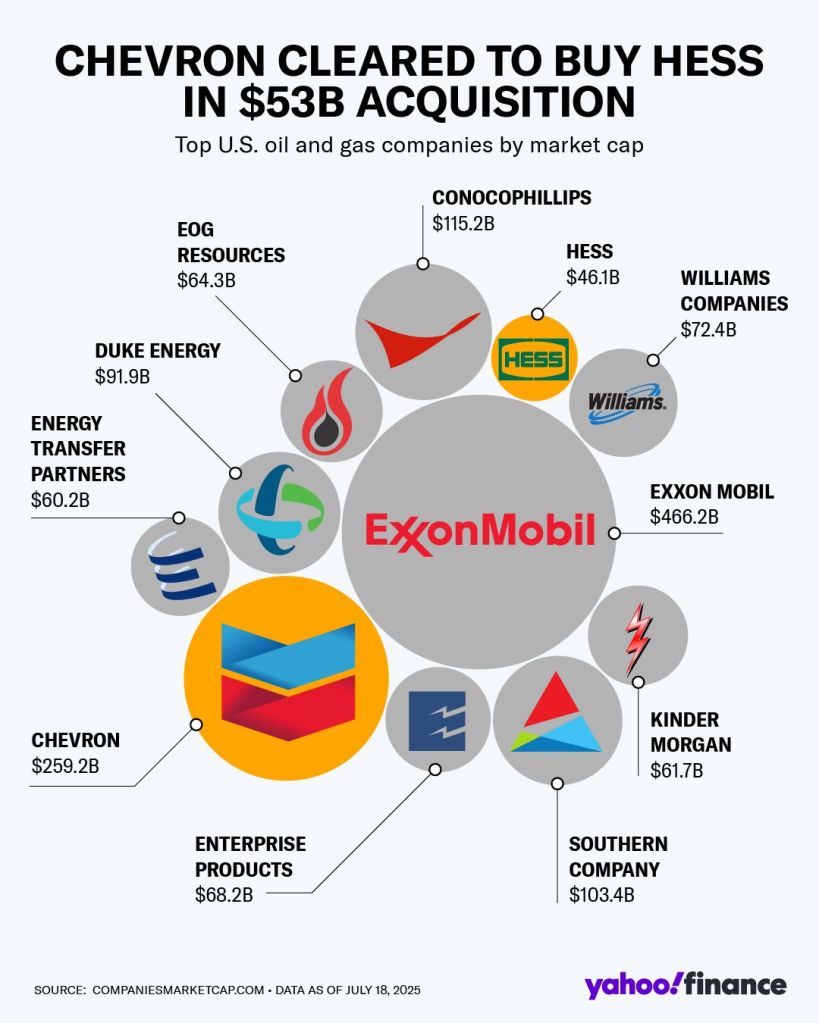

Therefore, this is not a strategy of “picking up pennies in front of a steamroller” as there is no carry and the outcome is binary – it is a discipline of rigorous probability weighting. The risk/reward assessment is the likelihood of the $5 gain against the probability of the $15+ loss, annualized over the expected deal timeline. Very few can do this well, and very few could’ve predicted the $53B acquisition of Hess by Chevron (the largest merger arb opportunity by purchase price in history).

Disciplined Investment Process

It is crucial to strictly separate activism (forcing a target company into a sale) from merger arb (betting on an already announced deal). The process below describes passive merger arb based on announced deals.

- Deal Sourcing and Filtering: the process begins with screening SEC filings (specifically 8-Ks) and press releases for the announcement of DPAs. The institutional edge here is not speed – high-frequency algorithms will always close the initial gap instantly upon news hitting the wire. The edge is in filtering – we are looking for signed, legally binding contracts. We discard “strategic reviews,” rumors, non-binding letters of intent (LOIs), or hostile approaches that lack a definitive agreement, as these carry exponentially higher risks.

- Financial Modeling and Return Analysis: we determine the gross spread and the annualized return. If a cash deal offers a 5% spread and we project it will close in exactly three months, that is roughly a 20% annualized return. This must be weighted against the downside. We then calculate an implied probability of closing based on current market pricing to see if the market is mispricing the risk.

- Legal Counsel and Contract Analysis: institutions employ teams of lawyers to dissect the DPA and the subsequent proxy statement. A retail investor must do this themselves.* You must evaluate the strength of the contract based on: conditions to closing, the “efforts” standard, financing contingencies, and the MAE clause.

- Execution and Hedging: the execution is dictated by deal structure: in an all-cash deal, you establish a long position in the target to capture the spread, with risk confined almost entirely to deal-breaking events. In a stock-for-stock transaction, you must execute a paired trade – long the target and simultaneously short the acquirer in the exact ratio specified by the merger agreement – to hedge the market exposure and lock in a market-neutral spread, as the arbitrage payoff is then derived from the convergence of the two securities upon deal completion, insulated from their individual price movements.

- Active Monitoring and Risk Triage: you are not writing activist letters like Daniel Loeb of Third Point, you are monitoring the spread like a hawk. If the spread expands significantly (the target company stock drops), the market is signaling increased fear of a deal break. You must determine if that fear is justified by new information or if it is merely market volatility creating a dislocation. The former may require existing the position to preserve capital (a stop loss); the latter may present an opportunity to deploy more capital at a higher annualized yield (increased conviction).

- Closing and Capital Recycling: upon the deal closing – with the spread collapsing to zero – your shares are converted to cash (or acquirer stock). If the goal of the merger arb sleeve is to deliver an uncorrelated alpha source, the cash is typically re-deployed to the next attractive spread to maximize the strategy’s annual return (compounding).

*The most challenging aspect of merger arb from this strategy outlined is the legal counsel and contract analysis. Before AI, a retail investor would not have the expertise (legal) or the time (many thousands of pages) to feasibly have any edge on this critical part in determining whether a deal will likely close.

Implications of AI for Alternatives

As I have discussed here, LLMs are incredibly good at finding non-linear relationships in unstructured big data (latent vector space in high dimension). What this means is that LLMs can easily parse thousands of pages of 8-Ks, DPAs, contracts, proxy statements, etc. And from analysis, come up with meaningful insights into whether a merger arb deal is likely to close say based on antitrust precedence it has searched using LexNexis.

With the advent of LLMs and the recent release of Gemini 3 (a step function increase from DeepSeek-R1), it is now possible for retail investors to digest the same public info as an institutional merger arb managers, and even gain more perceptive insights into the deal. This is why merger arb can become a feasible strategy for the engaged and astute retail investor. LLMs are starting to democratize investment strategies that have been in the exclusive domains of hedge funds and private equity.

What has been the PM’s job of a merger arb strategy to parse the guidance from say external legal counsel and equity analysts reporting to him – the core reasoning and insight of a PM – has now been embedded in these increasingly intelligent LLMs. Add to the fact that agentic coders like Cursor can now write automated programs to easily scan for Newswire press releases or 8-Ks on SEC Edgar, you can start to see how an advanced retail investor who is adept at using LLMs can start implementing a merger arb strategy (albeit at a small scale) with no liquidity constraints.

This is why I believe that PMs who don’t adapt and embrace AI will be left behind – they simply don’t have the sometimes astonishing insight that LLMs can share. They also can’t intelligently process the entire universe of publicly announced mergers as efficiently and methodically as a fine-tuned agentic AI customized for merger arb analysis. The key here is to understand what prompts (and prompt sequencing) to ask the LLM – this is a critical skill that will separate the average and the truly exceptional PMs of the future. Again I am not a professional merger arb investor or trader, so take this contrarian commentary with a grain of salt.

Leave a comment