Thesis: According to Coatue (a top thematic growth hedge fund), there are really only 4 options for getting power to AI datacenters in the short-term (< 5 years): two of which are unrealistic, and two realistic options with independent power producers (IPPs) being the dominant player for hyperscalers.

Independent Power Producers

- New generation: gas turbine takes 3-4 years to build

- New nuclear: next decade in a highly regulated market. Fission power is challenging enough, but fusion pushes boundaries of physical laws of nature – every element including the materials science (managing the extreme temps) touches on the edge of science.

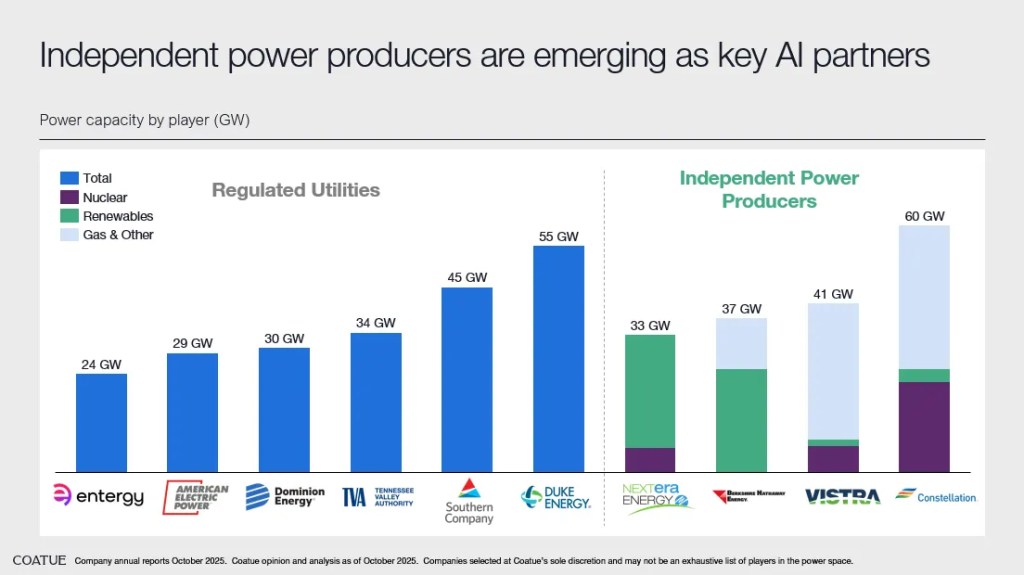

- Regulated utilities: Duke Energy $DUK (10%), Southern Company $SO (6%), Tennessee Valley Authority $TVC (preferred shares, 7%), Dominion Energy $D (11%), American Electric Power $AEP (28%), Entergy $ETR (24%). YTD performance are in paratheses. Capped upside / return on equity.

- Independent power producers (IPPs) – own generation assets like Constellation Energy $CEG (65%), Vistra $VST (28%) , Berkshire Hathaway Energy (subsidiary of $BRK), Nextera Energy $NEE (16%). Notably, this a small universe so any dominant market capture here will likely yield an oligopoly.

Investment Implications

This is a thematic trade over the next 5 years where unregulated IPPs will be a dominant player for AI datacenter power (oligopoly in the hyperscaler market).

Regulated utilities remain dividend plays with some added equity risk premium due to AI tailwind. Buildout of new generation (gas turbine) is likely to yield ROE faster than nuclear buildout (many tech here remains speculative, especially in SMR names like $SMR $OKLO).

A core position in a utility sector ETF like $XLU makes sense. The top 5 holdings (40% exposure) in descending order: NextEra (13%), Constellation Energy (8%), Southern Company (7%), Duke Energy (7%), American Electric (5%).

High-conviction expressions in individual names like $CEF $VST and $NEE may provide meaningful upside – layer on convexity with LEAPS and debit call spreads and you have high alpha potential close to the photonics marketplace growth we will be seeing in 2026.

Leave a comment