Paradoxical Truth: Oracle will likely win the AI cloud race because it was disqualified from the Web 2.0 cloud race dominated by Amazon, Microsoft and Google.

I am not an expert in relational databases, enterprise applications, or cloud services so my thesis will focus on an abstraction layer above the product level. I believe the conclusion of this thesis will still align with that of a product-level or fundamental financial analysis of $ORCL, but I may be wrong.

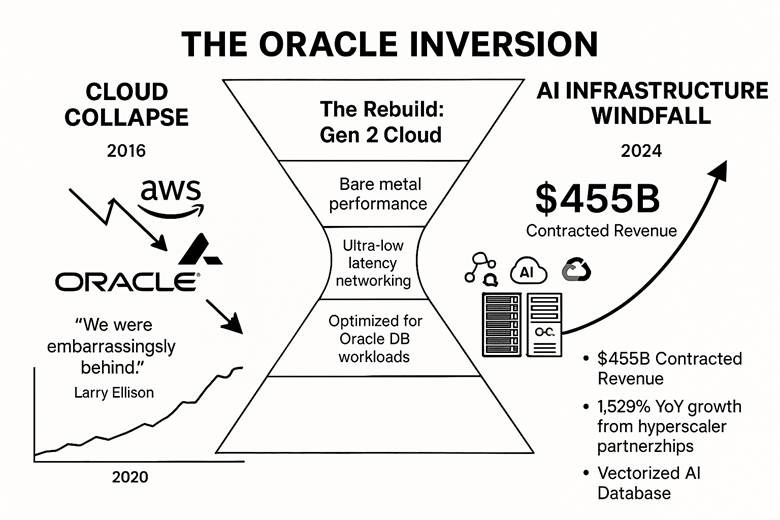

In any other capital cycle, being 10 years late ($AMZN AWS launched 2006 and Oracle OCI launched in 2016) to a multi trillion-dollar technological shift is a terminal death sentence. However, for this AI super-cycle ignited by the launch of ChatGPT 3 years ago, I believe it will inadvertently become Oracle’s ultimate asymmetric edge.

Bare Metal vs. Virtualization

Cloud computing is an oligopoly dominated by Amazon AWS, Microsoft Azure and Google Cloud. These goliaths and specifically AWS and Azure are now victims of their own early success. Their cloud empires are built on a computer science concept known as virtualization (with hypervisors being the software that runs these virtual machines) – it is essentially a software middleman designed for the Internet’s web-based expansion from 2000-2020 (Web 2.0).

While virtualization provided the elastic scaling necessary for Web 2.0, it has become the terminal bottleneck for an era of AI based on physical limits – an era where your edge as a hyper-scaler is determined by your ability to manage physics (latency), chemistry (cooling), and geography (sovereignty). For SOTA LLMs, the overhead of a virtual machine is no longer an efficiency trade-off – it is a structural failure that renders modern clusters economically unviable.

Because Oracle had no legacy virtualized kingdom to protect, they built OCI with a bare-metal centric architecture. By bypassing the software middleman, Oracle gives hyper-scalers direct, unfettered access to the GPU servers.

Enterprise AI with Private Data

But then, isn’t OCI just a GPU cloud provider like CoreWeave $CRWV or Nebius $NBIS?

Yes, if you just look at the product at at point-blank value. However, the key distinction is that the market still views GPU cloud providers based on a utility of scale – a borderless pool of shared resources. But for sovereign nations, hyper-scalers, and many enterprises, this scale actually becomes a vulnerability of jurisdiction.

While AWS and Azure are structurally bound to their public borderless DNA, Oracle is radically local – they house private data for the largest companies globally. Data that is confidential with many industries like finance and healthcare requiring strict data compliance regulation. Oracle has been doing this for decades and is deeply embedded in these types of industries that rely on the reliability, consistency, and compliance that very few competitors outside of Oracle can provide.

With a captive clientele, Larry Ellison is executing a genius pivot by layering the AI software stack on top of his existing database foundation – allowing Oracle’s clients to build AI applications that relies on their sensitive private data. Data that they don’t want to potentially be seen by a GPU cloud provider like Nebius, which was formerly a Russian search engine, Yandex, and owned by Russian billionaire (Arkady Volozh).

AI Sovereignty

But this type of data sovereignty extends beyond companies – it extends to countries and states like China and the EU which is especially sensitive to data regulation and compliance (GPDR and EU AI Act).

During its latest earnings call, Oracle revealed $523 billion in RPOs (remaining performance obligation) – a staggering 438% increase yoy. Although most of this backlog is driven by hyper-scalers and frontier LLM shops like OpenAI and Anthropic, I suspect sovereign capital will begin exploring partnerships with Oracle to leverage its durable moat as a gatekeeper of national intelligence. Due to their virtualization-based infrastructure and business model, AWS and Azure will likely struggle to fill this demand that will become a critical criteria for sovereign states – a classic innovator’s dilemma.

Just recently, Oracle announced a major expansion of its first AI supercluster in the Middle East with Abu Dhabi. Here is Larry Ellison’s sovereign pitch – it is quite effective.

Oracle’s distributed cloud offerings deliver the full benefit of OCI to governments, regulated industries, and enterprises that require control over data residency, latency, and AI sovereignty. They provide the same portfolio of over 200 AI and cloud services, APIs, SLAs, and pricing as in Oracle’s public cloud. With live and planned operations in more than 200 regions, Oracle is the only hyperscaler capable of delivering its entire suite of AI and cloud services at the edge, in a customer’s data center, across clouds, or in the public cloud.

Risks and Catalysts

From a risk perspective of this long thesis, I see four main ones:

- Duration risk: half-trillion dollar backlog that depends on OpenAI demand pulling through in a timely fashion (e.g., no delays in the AI Stargate Project).

- Regulatory pivot: the EU decides that Oracle (a U.S. firm) is still too much U.S. jurisdiction despite the air-gapping – which could be precipitated by a continued deterioration in Trump’s relationship with the EU.

- Bare-metal edge: a breakthrough in “hypervisor efficiency” from Amazon or Microsoft that closes the latency gap with bare-metal servers.

- Financial asymmetry: Oracle’s CDS (credit default swaps) are already hitting highs; a credit downgrade could significantly increase the capex of their ambitious buildout.

Great, the long thesis makes sense. But are there any catalysts for a re-rating? Look, the largest catalysts in this AI infra buildout has “come out of the blue,” so I won’t speculate here, but just share some announced catalysts.

- Zettascale10 supercluster launch: Oracle has officially partnered with $NVDA to launch the largest AI supercomputer in the cloud – powered by a staggering 800,000 GPUs.

- Department of Energy partnership: the DOE announced a partnership with Oracle to build the largest AI supercomputer (100,000 Nvidia GPUs) in the DOE complex.

- Oracle AI World Tour 2026: Oracle is launching a global offensive to capture sovereign capital directly (EU, Middle East, Asia and Australia events pictured below).

Leave a comment