Catalyst: the market is underpricing the likelihood of a successful Trump impeachment based on the Epstein files in 2026.

This is not a Black Swan event technically – it is an unknown unknown – but even as a known unknown it potentially carries the same max drawdown as a Black Swan.

With judicial and congressional immunity on the surface, Trump, Pam Bondi, Kash Patel, House Speaker Mike Johnson, and Senate Leader John Thune appear to be impervious to any material ramifications from their continued obstructions of justice in releasing the full Epstein files.

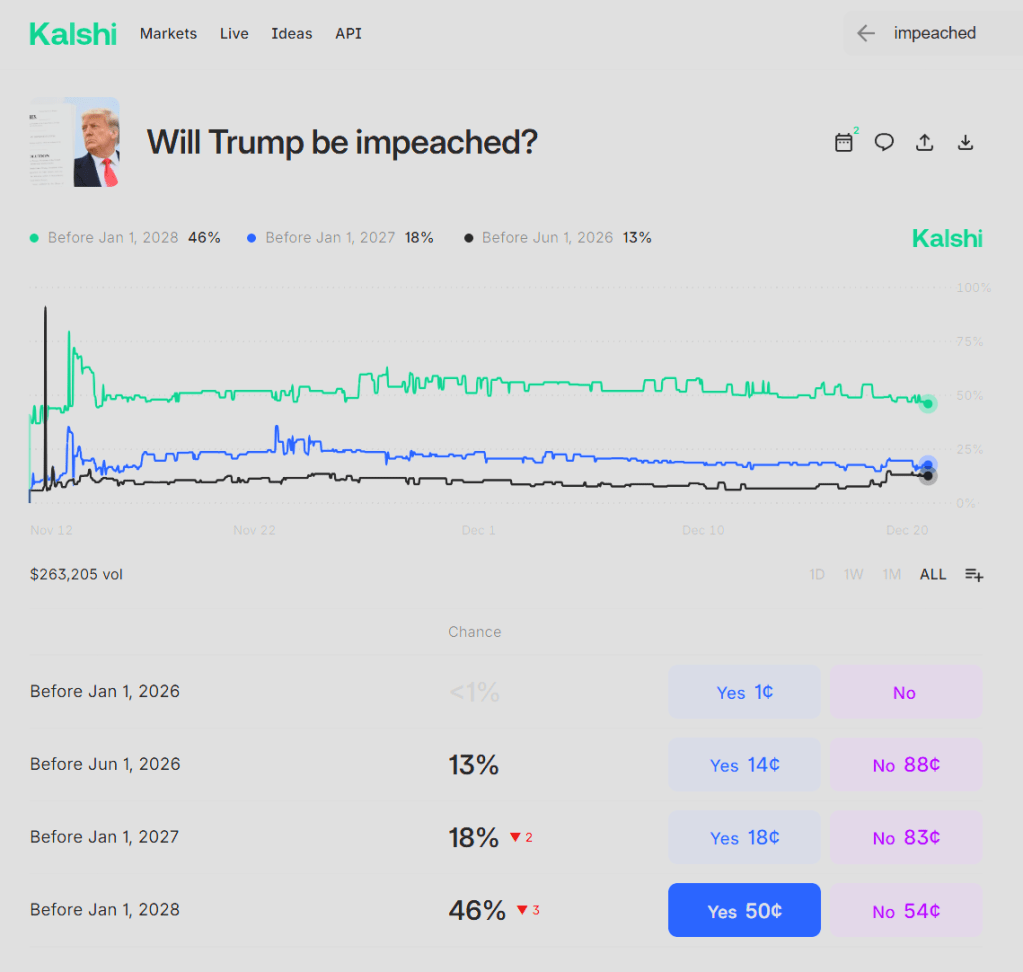

However, I do believe there are growing cracks in the Republican bench (notably Thomas Massie of Kentucky and formerly Marjorie Taylor Greene of Georgia) that could lead to enforcement for the full release and the successful impeachment of Trump. According to Kalshi, it poses a material risk which I believe may be under appreciated.

Hedging Options

At first glance, here are the options:

- Tactical: buy debit put spreads or VIX calls ahead of an announced deadline that would force the full release of the Epstein files.

- Tactical: increase short exposure – especially to names like $PLTR and $QUBT that have largely benefited from Trump’s policies.

- Permanent: buy deep OTM puts.

Option 1 is too risky as we have just seen on 12/19/25 when Pam Bondi and her Deputy AG Todd Blanche blatantly violated the Epstein Transparency Act passed into law a month ago.

If you’re Mark Spitznagel – a hedge fund manager renowned for his tail risk strategies – you would advocate for Option 3 – building a structured ladder of deep OTM puts to maximize downside convexity. Spitznagel would advocate that you allocate about 3% of permanent capital to this tail risk sleeve as it would deliver better returns both on an absolute and risk-adjusted basis historically.

Option 2 is interesting as there are many names like $PLTR, $QUBT, $MP and even $TSLA that are deeply tied to Trump’s policies. A replacement of Trumpian policies for something more aligned with economic reality (e.g., quantum computing) would be catastrophic for the market’s perception of growth in these names.

What is the optimal Epstein hedge?

Look, I am not an expert in tail risk hedging and don’t claim to be so you can take my advice with a grain of salt. I just have practical experience managing a tactical convexity sleeve that have proven effective in recent downturns like the April Trump Tariffs and 2022 inflation shock.

My perhaps naive assessment? Option 3 makes sense along with a prudent, complimentary layering of Option 2 – however, shorting is incredibly challenging due to the multitude of factors that needs to align, so be diligent if you intend to go this route.

That said, I may be wrong completely and 2026 proves to be another year where Congress, the Supreme Court and the Justice Department continue to defy the Constitution and the laws that govern our country (except for Trump apparently).

Down on his knees the Bishop fell,

And faster and faster his beads did he tell,

As louder and louder drawing near

The gnawing of their teeth he could hear.

And in at the windows and in at the door,

And through the walls helter-skelter they pour,

And down from the ceiling and up through the floor,

From the right and the left, from behind and before,

From within and without, from above and below,

And all at once to the Bishop they go.

They have whetted their teeth against the stones,

And now they pick the Bishop’s bones:

They gnaw’d the flesh from every limb,

For they were sent to do judgment on him!

-Robert Southey

Leave a comment